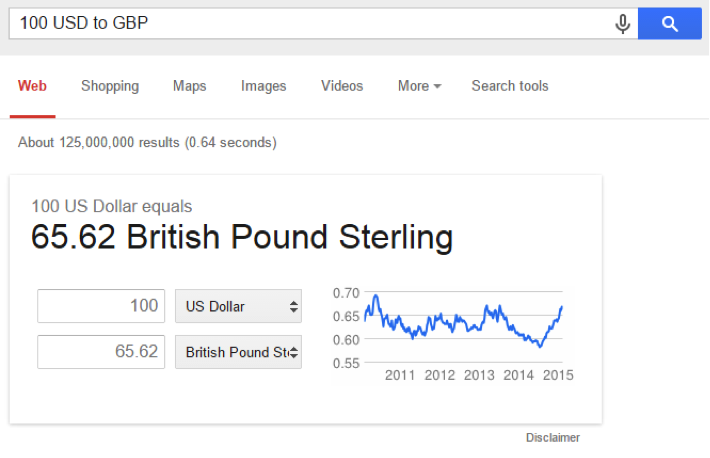

Google are forever testing and releasing new features in their SERPs, with a view to keeping searchers on their property as long as possible. There are simple features such as their currency converter or you can do basic calculations straight in the results.

The Google Knowledge Graph has historically been quite prominent in this area for travel queries for example, taking over more of the on-screen real estate which was traditionally dominated by sponsored ads and organic listings:

This week, Google has given us a new tool, their Mortgage Calculator. It has the ability to do a quick simple calculation based on a mortgage amount, interest rate and mortgage period resulting in the total cost of the mortgage and monthly payment value being presented to the user. It’s quick and simple to use and therefore very effective for a quick calculation.

Pete Meyers reported the test in December and tweeted about it being live earlier this week.

The same functionality can not yet be seen in UK SERPs. It should be noted that UK SERPs do currently present the user with similar functionality:

Users can still add the details to calculate the repayments, the core differentiator here is that on hitting the calculate button users are directed to Google’s own comparison engine as opposed to the new US feature which gives an answer directly in the search results.

In both instances, this may be a concern for the financial industry. Calculators and tools on finance sites can be a huge traffic driver if they are useful and user-friendly. Financial brands provide everything from ISA Calculator tools to tax relief calculators and mortgage calculators. Tools like this are a valuable asset due to the complexities of the financial services industry and the required eduction and understanding of complex products.

The essence of content marketing is about providing engaging and useful assets to the end user, something to make their lives easier and solve complex problems in a simplistic manner. Tools are an extremely effective way of doing this. Particularly in the finance sector, interactive assets can leads users to understand products and services better and provide a way to de-mystify and visualise complexities which would be difficult to explain via standard text based content.

Google are effectively tapping into this need in the same way brands are and are of course making money on the way. Their foray into these simplistic tools within the search interface reduces brands’ ability of driving equity via an educational user journey.

The UK version of the mortgage calculator also allows Google to tap into a revenue opportunity via affiliate style compensation. It’s a win win as usual. Brands pay for PPC listing within the Google ecosystem, then they also pay Google if a purchase comes via their comparison engine which coincidentally will always appear above any regular organic listing.

It’s difficult to assess what the overall impact of this introduction will have on brands competing for ‘mortgage calculator’ style terms. What is clear is that Google will be ranking on top going forward.